This guide is intended for merchants interested in using Fabrick’s Open Payments services and currently operating with other PSPs (Payment Service Providers).

Its purpose is to assist the merchant in migrating recurring payments to Fabrick’s infrastructure, with a particular focus on card and PAN token data.

What is a card token?

A card token is a unique identifier that replaces the PAN (Primary Account Number)—the number printed on the payment card.

Tokenization allows transactions to be processed without using the actual PAN, enhancing protection against fraud and data breaches.

For more details, see Fabrick’s article:

What is Tokenization and its key role in international payments

What are recurring payments?

Recurring payments are transactions processed on a regular basis (e.g. monthly subscriptions, installment plans), without requiring the customer to enter their card details each time.

In MIT (Merchant Initiated Transactions), the merchant initiates the payment based on a prior customer authentication.

See also the official Axerve documentation:

MIT Recurring Payments – Fabrick Docs Payment Orchestra

Migration goal

To import all necessary data for managing existing recurring payments, ensuring freedom of choice and operational continuity for the merchant.

Technical file requirements

To complete the migration process, the merchant (or current PSP) must provide one or more files containing the required data in CSV format, following the technical specifications outlined below.

File format

CSV format encoded in UTF-8

All rows must have the same number of columns

Columns can be in any order

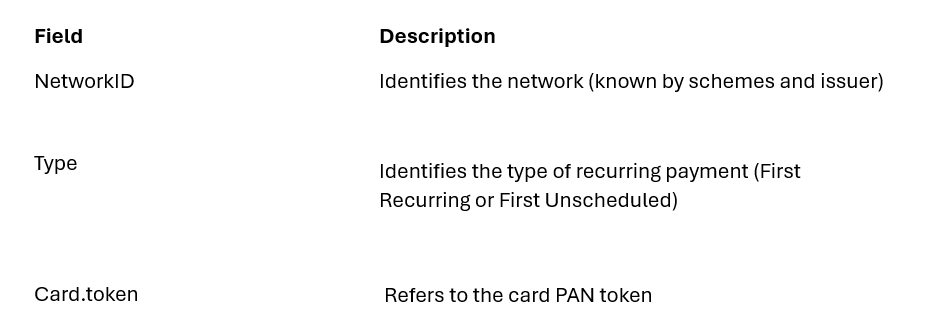

Mandatory fields for recurring transaction migration

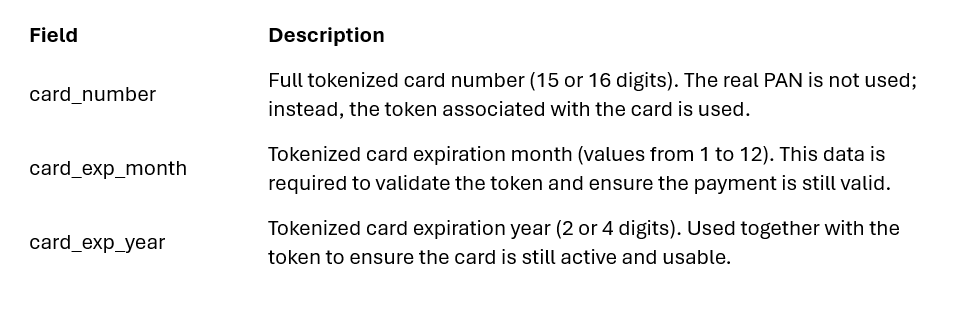

Mandatory fields for PAN tokenized card migration

Typically, a recurring payment chain—authenticated during the user's first transaction—is used in combination with tokenized card PANs. This approach helps avoid the use of sensitive data in subsequent transactions.

Currently, Fabrick supports card tokens from MasterCard and VISA networks.

If the recurring transaction was previously authenticated using a PAN token, the following fields are mandatory for migration:

For more information about tokenization and compatible card networks, refer to the Fabrick article:

What is Tokenization and its key role in international payments

Optional fields

The originating PSP may include additional fields in the CSV file, beyond the mandatory ones.

These data will be used by Fabrick to offer the merchant a migration process that is as seamless and complete as possible.

Examples of useful additional information may include metadata, internal IDs, customer references, contact details, preferences, etc.

At the end of the migration, Fabrick can provide the merchant with a file containing the new reference data identifying the recurring transaction chains and card tokens, matched with the original data provided by the merchant for easy identification and archiving.

File name

The file can be named freely, but the following format is recommended:

<DATE><MERCHANT_NAME><DATA_TYPE>.csv.gpg

Security and file delivery

The CSV file must be encrypted using the Fabrick public key, which will be provided on a case-by-case basis.

Fabrick’s preferred delivery method is via a sFTP server managed by Fabrick, where the counterpart can directly upload the files.

Connection details (server name, port, and credentials) will be provided individually once the migration process is initiated.

Expected timeline

Once the correct and complete data has been received, Fabrick will make every effort to enable the merchant as quickly as possible.

Depending on the volume and quality of the data, the process may take from a few days to several weeks.

Contacts

For assistance with preparing the data or setting up secure file transfer, please contact the Fabrick technical support team.